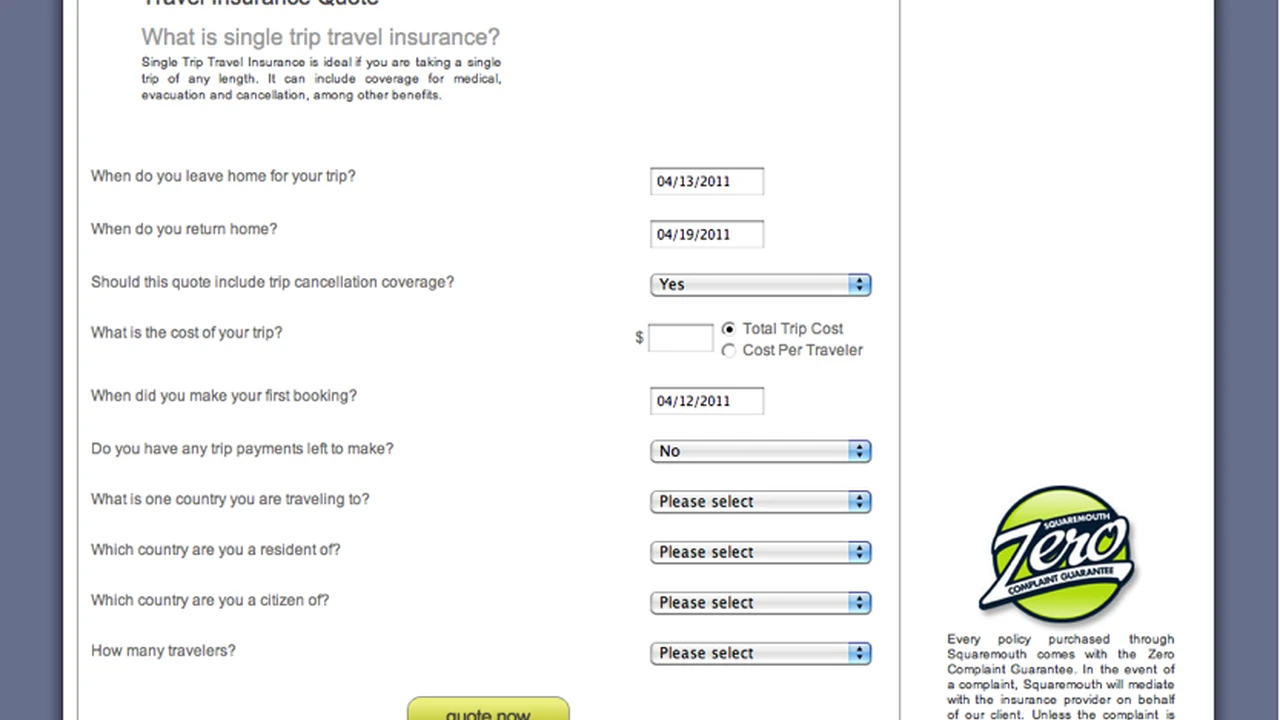

City Travel Insurance Comparison

Protect your trip with affordable travel insurance. Compare different insurance plans, considering coverage for medical emergencies, lost luggage, and trip cancellations. Travel with peace of mind, knowing you're protected.

Why You Absolutely Need Travel Insurance for Your City Adventures

Okay, let's be real. You're under 30, invincible, and ready to conquer the world, one city at a time. Travel insurance? Sounds boring, right? Like something your grandma would worry about. But trust me on this one. A seemingly minor mishap can quickly turn your dream trip into a financial nightmare. Think about it: a sudden illness, a missed flight, lost luggage, or even a stolen phone. These things happen, and they can happen to you. Travel insurance is your safety net, your \"oops, I messed up\" fund, and your peace of mind all rolled into one. It's a small price to pay for the security of knowing you're covered when things go sideways.

Understanding Different Types of Travel Insurance for Urban Explorers

Not all travel insurance policies are created equal. There's a whole world of options out there, and it can be overwhelming. Here's a breakdown of the key types you should know about:

- Trip Cancellation Insurance: This covers you if you have to cancel your trip due to unforeseen circumstances like illness, injury, or a family emergency. Imagine booking a non-refundable flight and then catching the flu the day before departure. This insurance can save you from losing all that money.

- Trip Interruption Insurance: Similar to cancellation insurance, but this kicks in if your trip is interrupted after it's already started. Think a hurricane hitting your destination or a sudden family emergency back home.

- Medical Insurance: This is crucial, especially when traveling abroad. Your regular health insurance might not cover you in other countries. Medical insurance covers doctor visits, hospital stays, and even emergency medical evacuation.

- Baggage Insurance: Covers lost, stolen, or damaged luggage. This can be a lifesaver if the airline loses your bag with all your clothes and essentials.

- Travel Delay Insurance: Reimburses you for expenses incurred due to flight delays, such as meals and accommodation.

Key Factors to Consider When Comparing Travel Insurance Plans

So, you're ready to shop for travel insurance. Great! But before you click \"buy,\" consider these important factors:

- Coverage Limits: How much will the policy actually pay out in case of a claim? Make sure the limits are high enough to cover potential expenses, especially medical bills.

- Deductible: How much do you have to pay out of pocket before the insurance kicks in? A lower deductible means you'll pay less upfront, but the premium might be higher.

- Exclusions: What's not covered by the policy? Read the fine print carefully to understand any exclusions, such as pre-existing medical conditions, extreme sports, or acts of terrorism.

- Destination: Some policies are specific to certain regions or countries. Make sure the policy covers your intended destination.

- Duration: How long will the policy be in effect? Ensure it covers the entire duration of your trip, including travel days.

- Activities: If you plan on engaging in adventurous activities like hiking, surfing, or scuba diving, make sure the policy covers them. Some policies exclude certain high-risk activities.

Top Travel Insurance Providers for Under 30s: Product Recommendations and Comparisons

Alright, let's get down to the nitty-gritty. Here are a few travel insurance providers that are popular with young travelers and offer competitive rates and comprehensive coverage:

- World Nomads: A favorite among backpackers and adventurous travelers. They offer flexible plans, coverage for a wide range of activities, and 24/7 emergency assistance. Typical Price: $50-$150 per trip, depending on coverage and duration. Use Case: Ideal for adventurous trips involving hiking, diving, or other outdoor activities. Comparison: More expensive than some basic plans, but offers superior coverage for adventurous activities.

- Allianz Travel Insurance: A well-established provider with a variety of plans to suit different needs and budgets. They offer trip cancellation, medical, and baggage coverage. Typical Price: $30-$100 per trip. Use Case: Good for general travel, covering trip cancellation, medical emergencies, and lost luggage. Comparison: Offers a good balance of price and coverage.

- Travel Guard: Another reputable provider with a wide range of plans, including options for cruises and tours. They offer 24/7 travel assistance and claims support. Typical Price: $40-$120 per trip. Use Case: Suitable for various types of travel, including cruises and packaged tours. Comparison: Offers specialized plans for specific travel types.

- SafetyWing: Targeted towards digital nomads and long-term travelers. They offer affordable, subscription-based coverage with flexible start dates and the ability to cancel anytime. Typical Price: $42 per 4 weeks. Use Case: Perfect for digital nomads and long-term travelers who need continuous coverage. Comparison: Very affordable for long-term travel, but may not cover all activities.

Decoding the Jargon: Understanding Common Travel Insurance Terms

Travel insurance policies are often filled with confusing jargon. Here's a quick glossary of common terms to help you understand what you're reading:

- Pre-existing Condition: A medical condition you had before purchasing the insurance policy. Some policies may exclude coverage for pre-existing conditions.

- Beneficiary: The person who will receive the insurance payout in case of your death.

- Premium: The amount you pay for the insurance policy.

- Claim: A request for payment from the insurance company for a covered loss.

- Policy: The contract between you and the insurance company outlining the terms and conditions of coverage.

Real-Life Scenarios: How Travel Insurance Saved the Day

Let me tell you a few quick stories to illustrate the importance of travel insurance:

- Sarah's Story: Sarah was backpacking through Southeast Asia when she contracted a severe case of food poisoning. Her travel insurance covered her medical expenses and a hospital stay, saving her thousands of dollars.

- Mark's Story: Mark was traveling to Europe for a conference when his flight was delayed due to a snowstorm. His travel insurance reimbursed him for his hotel and meals, allowing him to attend the conference without missing a beat.

- Emily's Story: Emily was exploring New York City when her purse was stolen, including her passport, credit cards, and phone. Her travel insurance covered the cost of replacing her passport and reimbursed her for the stolen items.

Tips for Filing a Travel Insurance Claim Successfully

So, you've had a covered loss and need to file a claim. Here are some tips to make the process as smooth as possible:

- Document Everything: Keep copies of all receipts, medical records, police reports, and other relevant documents.

- Notify the Insurance Company Promptly: Contact the insurance company as soon as possible after the incident.

- Provide Accurate Information: Be honest and accurate when filling out the claim form.

- Follow Up: Keep in touch with the insurance company and follow up on the status of your claim.

Travel Insurance for Specific City Activities: What to Look For

Planning on hitting up some specific activities on your city break? Make sure your insurance covers them! Here's a quick rundown:

- Concerts and Festivals: Check for cancellation coverage if the event gets canceled due to weather or other unforeseen circumstances.

- Sporting Events: Ensure you're covered for injuries if you plan on participating in any sports activities.

- Guided Tours: Verify that the tour operator has their own insurance, but also consider having your own coverage in case of accidents.

- Public Transportation: Some policies offer coverage for lost or stolen items while using public transportation.

The Bottom Line: Protecting Your City Break Investment

Look, nobody wants to think about things going wrong on their vacation. But the reality is, travel mishaps happen. Travel insurance is a smart investment that can protect your financial well-being and give you peace of mind while you're exploring new cities. So, do your research, compare different plans, and choose a policy that fits your needs and budget. Trust me, you'll be glad you did.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)